|

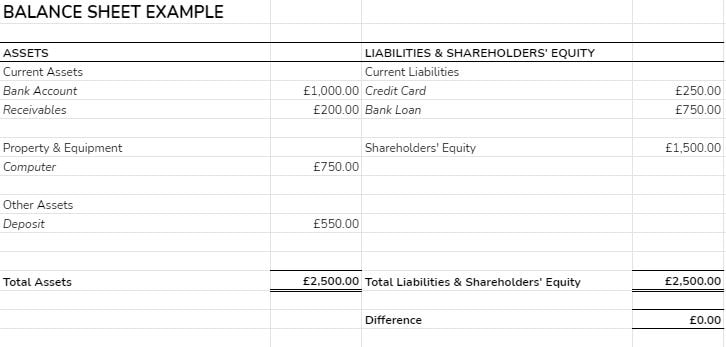

The Balance Sheet is one of three key financial statements for your business, along with the Profit & Loss Statement and the Cash Flow Forecast. Together these statements provide insight into your business’ robustness and financial sustainability, as well as it’s potential for growth. Whilst these reports should be used collectively, we’d like to dedicate the next few articles to go a little more in depth into each one, starting here with the balance sheet. What is a balance sheet?A Balance Sheet is a snapshot of all of your business’s Assets (what your business owns), Liabilities (what your business owes) and Shareholders’ Equity (Your business’s long-term investments), at a specific point in time. This is unlike the Profit and Loss Statement, which shows different data pertaining to your business’s level of profitability or the lack thereof, and accounts for all activity within a period of time. In the world of accountancy there is a “Balance Sheet Equation”, which looks a little something like this: Assets = Liabilities + Shareholders’ Equity And this forms the basis and structure of the balance sheet, which is made up of two columns, the totals of which must equate to the same value. For example: The balance sheet is appropriately named because an entry on one side will create a subsequent entry on the other, which results in both columns balancing. For example - a business owner takes out a loan of £50,000. This increases his business liabilities by this amount, whilst simultaneously also increasing his cash assets by £50,000, and therefore leaving the two columns in symmetry. How to create a balance sheetAccounting Software All figures that appear on the balance sheet, as well as the other financial statements, are fed through from all of your day-to-day double entry bookkeeping transactions. This means that if you’re using an electronic accounting software, your balance sheet can be created with a tap of a few buttons, as the report is built into the software package and uses data stored in it’s database to populate it. For instance, using the Xero accounting package, the process looks like this:

> Compare to: Which previous period you’d like to compare the current balance sheet with (this will typically be the last month) > Compare Periods: How many previous periods would you like to compare with this one (For example, if just the previous month, then “Previous 1 Period”

It can be that simple! Manual Approach If however you’re using more manual methods, then you’ll need to build them from your prime bookkeeping records, and use the structure as suggested here, or via other online resources. You can build the balance sheet using a spreadsheet or by hand, but a spreadsheet would be the most cost-effective of the two. Include the following elements in your balance sheet: ASSETS

LIABILITIES

SHAREHOLDERS' EQUITY This is the initial amount of money invested in the business by its owners or external investors, as well as Reserves, such as business profits accumulated over the years. How to use a balance sheetWhilst the balance sheet provides key information on it’s own, it should ideally be used alongside the other financial statements to provide a full and clear vision of the business’s current financial health and operational efficiency. At a quick glance, the balance sheet alone offers insight into your business’s net worth, how liquid it is - how able your business is to cover its short-term obligations, and how indebted it is. This information can then be used to assist the decision process for investors and lenders, in accepting a financing application from your business.

Here are a few pointers on how a balance sheet can be used. Balance Sheet Comparison A balance sheet can be compared with previous balance sheets to identify trends in the data that may only be visible over a longer period of time. It can also be compared with the balance sheets from other businesses within the same market. Here are a few examples of trends you might identify:

Financial Ratio Analysis Business owners, investors and lenders can use a variety of ratio equations, referred to as “Ratio Analysis” to deduce key information about the business from the business’s financial statements. Whilst the term itself can seem daunting for many, in particular new business owners or financial novices, the equations themselves are relatively simple and straightforward to apply. There are a wide variety of financial ratios, and often they are used alongside others to show a more rounded story of your business. Here are a few that are specifically associated with the balance sheet to get you started:

The equation is: Total Liabilities / Total Shareholders’ Equity

The equation is: Current Assets / Current Liabilities

The equation is: Current Assets - Inventory / Current Liabilities All of these metrics are known as “Financial Strength Ratios”, because they show the financial strength of your business. We hope this has helped to demystify the balance sheet somewhat. Stay tuned for our next article on the Profit and Loss Statement.

0 Comments

|

Archives

July 2021

Categories

All

|

What would you like to do next?

|

|

I AM INTRIGUED AND WOULD LIKE TO KNOW MORE ABOUT WHAT YOU DO |

|

Book a clarity call

Book a clarity call

Tel: 01173 182 245

Mobile: 07414 277876

Mobile: 07414 277876

PRIVACY POLICY COOKIE POLICY STANDARD TERMS

Pyramis Solutions Ltd is a registered company in England & Wales. Company Registration Number: 11083273;

Company Registered Address & Company Office Address:

Future Space, UWE North Gate, Filton Road, Bristol, BS34 8RB.

Pyramis Solutions Ltd is a registered company in England & Wales. Company Registration Number: 11083273;

Company Registered Address & Company Office Address:

Future Space, UWE North Gate, Filton Road, Bristol, BS34 8RB.

Site powered by Word Gets Around

RSS Feed

RSS Feed