|

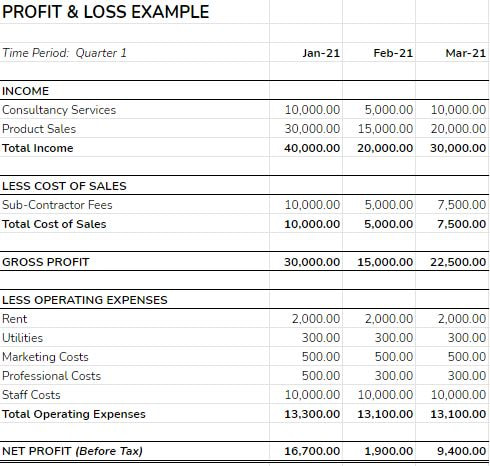

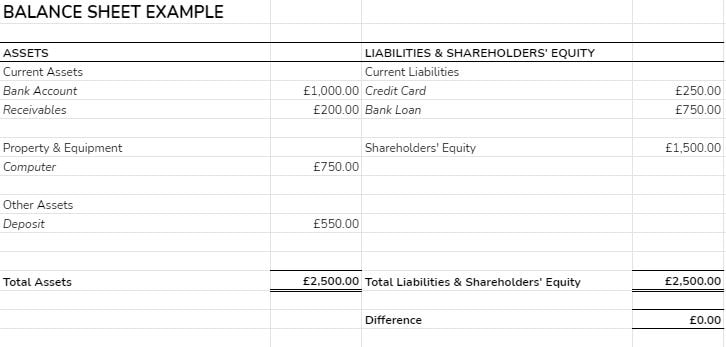

The Profit & Loss Statement (also known as the Income Statement) is one of the three key financial statements for your business, along with the Balance Sheet and the Cash Flow Forecast. Individually & collectively, these statements provide important insights into the health or your business and inform decision makers with the information needed to drive positive change, such as increasing profits and operational efficiency whilst maintaining quality and ethics. Let’s dive in and look a little deeper into what the Profit and Loss Statement is, and how to produce & and use it. What is a Profit & Loss?A Profit & Loss Statement (P&L) shows the total of your business’s Income (money coming into your business) & Expenses (Cost of Sales & Operating Costs) (money that relates to your core business operations going out) over a set period of time, whether monthly, quarterly or annually. At its core, the purpose of the P&L is to reveal whether or not your business is making money, as well as providing insights into the financial effectiveness of your business operations and overall health of your business. It differs from the Balance Sheet in that it reports on different financial activity types; this is why the different financial statements can be used collectively to build a full picture of your business. In the world of accountancy there is a “P&L Formula”, which looks a little something like this: Revenue - Expenses = Profits or Losses An example Profit & Loss Statement is provided below:

|

Archives

July 2021

Categories

All

|

What would you like to do next?

|

|

I AM INTRIGUED AND WOULD LIKE TO KNOW MORE ABOUT WHAT YOU DO |

|

Book a clarity call

Book a clarity call

Tel: 01173 182 245

Mobile: 07414 277876

Mobile: 07414 277876

PRIVACY POLICY COOKIE POLICY STANDARD TERMS

Pyramis Solutions Ltd is a registered company in England & Wales. Company Registration Number: 11083273;

Company Registered Address & Company Office Address:

Future Space, UWE North Gate, Filton Road, Bristol, BS34 8RB.

Pyramis Solutions Ltd is a registered company in England & Wales. Company Registration Number: 11083273;

Company Registered Address & Company Office Address:

Future Space, UWE North Gate, Filton Road, Bristol, BS34 8RB.

Site powered by Word Gets Around

RSS Feed

RSS Feed